- July 20, 2022

- No Comment

- 26 minutes read

China Pet Market – Investing in the Multi-Billion Dollar Industry – China Briefing

China’s pet industry is booming. Long gone are the days when animals mainly served a practical function, today, they have become an integral part of the family – especially for younger people who are increasingly shunning traditional family structures. As demographic and cultural trends continue to shift, China’s pet market shows huge potential for growth, offering a treasure trove of opportunities for investors. In this article, we look at the latest trends and opportunities for investors in the China pet market, from the production of pet food to pet tech and accessories to veterinary services and more.

On June 10, the hashtag #China’s single households surpass 125 million# began trending on the microblogging website Weibo after the finance channel of China Central Television (CCTV) posted a video about how younger single men and women are driving a boom in pet keeping.

Younger generations are increasingly choosing not to marry and have children – a phenomenon reflected in the plummeting birth rate seen over the last few years – and many are therefore turning to man’s furry friends for emotional fulfillment. Rising incomes and improving living standards, occurring in tandem with increased urbanization, means people have more disposable income to spend on their pets – whether that is on food, healthcare, toys, or experiences – providing a huge opportunity for companies operating in these spaces.

With new pet owners tending young, well-educated, and wealthier, the pet industry is set to see explosive growth over the next decade. In this article, we discuss the growth of China’s pet industry and new trends and opportunities for foreign investors.

China’s pet industry has grown rapidly over the last two decades. Although the industry first began to emerge in the 1990s with the entrance of multinational pet brands, such as Mars Inc. and Nestle Purina Pet Food, as well as the launch of the first China International Pet Show in 1997, the trend of pet-keeping first began to take off in earnest in the 2000s. Cultural attitudes toward keeping animals as pets began to shift along with increasingly relaxed views on marriage and children, at least among the younger generations. The first domestic pet brands and animal hospitals began to develop during this period, with a focus on cats and dogs in particular.

The number of pets began to grow more significantly from 2010 onward, as millennials entered the workplace and increasingly formed so-called “dual income, no kids” (DINK) families, along with increased urbanization. Interest in more niche and exotic animals, such as reptiles, rodents, and aquatic animals, rose, and as China’s domestic e-commerce industry flourished, pet retail also began to move online, with platform companies such as JD.com and Alibaba’s Taobao offering pet products.

The pandemic has sped up many of the existing trends seen in the pet industry and is likely a factor for the explosive growth in pets over the last few years. As people spend more time at home and white-collar offices adopt hybrid or remote work models, more people have the capacity to care for a pet. The pandemic also accelerated the shift to online purchases of pet products, likely to the detriment of brick-and-mortar pet stores.

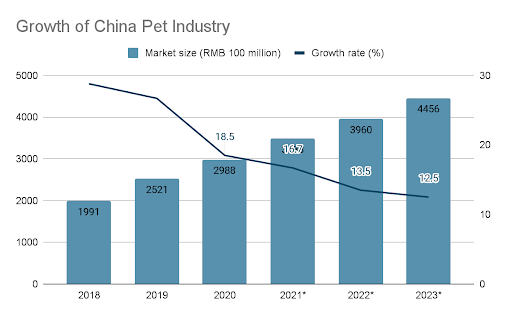

According to the 2021 White Paper on China’s Pet Consumption Trends produced by consumer research firm iResearch (the “iResearch white paper”), China’s pet industry was worth RMB 298.8 billion (US$44.4 billion) in 2020 and reached a projected RMB 348.8 billion in 2021, a year-on-year growth rate of 16.7 percent. The iResearch white paper also projects the industry to reach RMB 445.6 billion (US$66.1 billion) by 2023.

*Estimate.

Source: iResearch White Paper on China’s Pet Consumption Trends

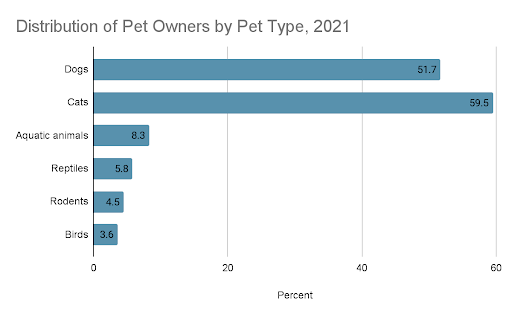

The number of cats kept as pets overtook dogs for the first time in 2021. There was a total of 58 million cats and 54 million dogs in China at year-end, according to market research firm Intelligence Research Group. The popularity of cats is also growing faster than that of dogs, growing 19.4 percent year-on-year in 2021, compared to just four percent growth in the number of dogs.

Source: 2021 White Paper on China’s Pet Industry (Consumption Report); Intelligence Research Group

Despite there being fewer overall dogs than cats, dog owners tended to spend more on their pets compared to cat owners. Data from the 2021 White Paper on China’s Pet Industry (Consumption Report) (“consumption white paper”) produced by the pet big data platform Pethadoop under the guidance of the pet industry branch of the China Animal Husbandry Association (not to be confused with the iResearch white paper) shows that the annual average spend per dog was RMB 2,634 (US$390.62), compared to RMB 1,826 (US$270.79) for cats.

The growth of the overall dog market also outpaced that of the cat market by a slim margin, reaching RMB 14.3 billion (US$2.1 billion) in 2021, up 21.2 percent from the previous year. The cat market was worth RMB 10 billion (US$1.5 billion) in 2021, growing 19.9 percent year-on-year.

As is the case with many other retail and service sectors, the COVID-19 pandemic spurred a shift to more online consumption of pet products and services. According to the consumption white paper, pet owners reported online platforms as their primary place to buy food products, with 74.5 percent buying pet food online, 73.1 percent buying snacks online, 64.2 percent buying nutritional products online, and 80.4 percent buying other pet supplies online.

Pet products were reportedly one of the product categories that saw considerable growth in consumption during the otherwise underwhelming 618 shopping festival on June 18, 2022, with transaction volume on Jingdong Pets – the dedicated pet platform of e-commerce company JD.com – exceeding the total transaction volume in 2021 in the first four hours of the festival.

However, offline shopping still remained relatively high in 2021 and has shown of recovering significantly. As China achieved a great level of success in containing the spread of COVID-19 in the latter half of 2020 and most of 2021, offline shopping has recovered significantly. For pet nutritional products, 47.9 percent of pet owners said they purchased them from animal hospitals, and 32 percent purchased them from pet stores.

In addition, the relaxing of COVID-19 restrictions in 2021 also gave way to the recovery of offline pet services, most commonly pet grooming, fostering, training, and pet recreational parks. Pet training saw a 116.7 percent year-on-year increase in 2021, while pet grooming grew by 31.7 percent.

In addition, the purchase of the animals themselves is still predominantly done offline, although online pet transactions are also increasing. According to the iResearch white paper, the majority of people acquired a cat or a dog either from an offline store or from a friend, family member, or acquaintance. Only 19 percent acquired a cat online and 13 percent acquired a dog online in 2020, despite the impact of the pandemic on offline consumption.

The increase in pet keeping is overwhelmingly driven by young and educated consumers. According to the consumption white paper, almost 90 percent of pet owners hold a university degree, despite only 23.61 percent of the overall population receiving higher education. In addition, 46.3 percent of pet owners were born after 1990, and 22.9 percent were born after 1995. Pet owners are therefore, naturally, also higher earners, with 46.7 percent earning between RMB 4,000 (US$593) and RMB 9,999 (US$1483), and 34.9 percent earning over RMB 10,000 (US$1,483).

Moreover, the length of time that a person has been a pet owner is relatively short. 52 percent of pet owners in 2021 had kept a pet for less than three years, and 19 percent had kept one for less than one year. In addition, the average number of pets per person in China remained mostly unchanged from 2020, despite the overall increase in the number of pets. Both of these statistics indicate that the growth in the market is driven in large part by new pet owners, rather than existing owners acquiring more pets, which combined with the fact that pet owners skew young suggests huge potential for market growth among younger generations.

Veterinary hospitals are becoming increasingly diversified in their offerings, with many also providing retail products and services such as grooming and pet sitting.

Veterinary hospitals are also becoming the preferred place to buy pet products, in particular food, snacks, and nutritional supplements, presumably due to the higher level of authority that a veterinary hospital enjoys. According to the consumption white paper, over 90 percent of pet owners said they had purchased products from a veterinary hospital, with over 40 percent saying they had purchased pet food from a hospital.

More and more consumers are also choosing veterinary hospitals for non-medical services, mostly grooming and pet sitting. 30.7 percent of pet owners choose hospitals for grooming – a three-fold increase from 2020 – and 17.7 percent choose them for pet sitting.

On the medical side, veterinary hospitals also show huge potential for growth. Notwithstanding the growing number of pets in the country which will require veterinary services, the current penetration rate of veterinary medicines remains on the low side. Therefore, as awareness of pet health and regulations increases, so does the potential for growth in the veterinary industry.

There are several sectors of the pet industry open to foreign investment, and many foreign-invested companies and multinationals have already entered the space. Sectors related to the pet industry included the Catalogue of Encouraged Industries for Foreign Investment (both the 2020 version and the 2022 draft version) include:

Below we discuss some of the market segments in the pet industry that present opportunities for investment.

Pet tech and electronics are becoming increasingly popular in China, as the tech-savvy millennials and Gen-Z ers combine their passion for pets and gadgets. Products such as automatic food and water dispensers, electronic collars, and home camera setups that let owners check in on and even communicate with their pets when they are out of the house are becoming the norm for pet owners. Many of these products also have “smart” features, enabling them to be connected to the internet and controlled and monitored via a user’s mobile phone.

Many companies in this sector are smaller start-ups with funding from venture capitalists and other institutional investors. The pet tech start-up Tortoise & Panda, for instance, has received seed investment from Hillhouse Capital and Daocin Capital. Some larger tech companies have also produced product offerings in this space, such as the electronics giants Xiaomi and Midea, although their scope of products remains limited to a few items. Other companies in this field include Petkit and iKuddle.

The single largest sector in the pet industry is pet food, which accounted for 51. 5 percent of the industry in 2021, according to the consumption white paper. However, the proportion of the pet food sector is shrinking, falling 10 percentage points from 2019, when the sector held a 61.4 percent market share. Meanwhile, the veterinary services sector increased by 10 percentage points since 2019, up to 29.2 percent from 19 percent.

In 2021, China’s pet food production reached 1.13 million tons, a year-on-year increase of 17.3 percent. The largest pet food producing regions in China were the northern provinces of Hebei and Shandong, which reached a production output of 429,847 and 268,064 tons respectively, according to data from the China Feed Industry Association.

China’s pet food market is relatively saturated, with many large multinationals dominating the market. Several foreign multinationals are active in the pet food market, including Royal Canin, Pedigree, Mars Incorporated, and Nestle Purina Petfood. In 2021, Nestle announced plans to expand its pet food processing capacity in China.

Many of these multinationals entered the market at a relatively early stage and therefore already enjoy strong brand recognition by Chinese consumers.

Domestic brands are catching up with multinationals. One of the largest domestic pet food companies is Yantai China Pet Foods Group, which owns several subsidiaries, including Wanpy, Dr Hao, and King Kitty.

In 2020, the scale of China’s pet product industry reached RMB 36.9 billion (US$5.5 billion), according to an industry report from Chinese capital market company Industrial Securities. This is a year-on-year growth rate of 14.13 percent. The largest market segments were hygienic pet products and daily necessities, which accounted for approximately 77 percent of the market combined.

This was followed by accessories and travel products (such as crates and carrier bags), which accounted for 16.91 percent, and pet toys, accounting for 6.11 percent.

The report also noted that the pet product market in China is highly fragmented, with market players mostly composed of three types of companies:

A large proportion of pet products, such as hygiene and other daily necessities, are characterized by a high-frequency and high volume of purchases, with pet owners buying an average of 2.7 daily necessity items and 2.5 hygiene products per quarter. Pet toys and clothing, being more durable, were purchased an average of 2.4 and 2.2 times per quarter.

In addition to Tianjin Yiyi Hygiene, major companies that provide pet hygiene products include U-Play Corporation and Jiangsu Zhongheng Pet Articles. Major companies in the pet clothing and accessories segment include Epet.com, Vetreska, and Pidan.

Veterinary services are the second largest market segment after pet food. The sector has reached a penetration rate of 75.8 percent, according to the consumption white paper, making it the fourth highest segment by penetration rate. In addition, less than 50 percent of cats and dogs were inoculated in 2021, despite being required to receive inoculation at least once a year. This suggests that the veterinary market has significant space to grow as demand and awareness increase.

The number of pet hospitals has also grown significantly over the past few years. China’s leading pet hospital company, Ruipeng Pet Hospital, now has over 800 locations across the country.

The pet medicine industry also has significant room for growth, with domestic companies’ capabilities still falling somewhat behind that of other developed countries. Several foreign players have entered the Chinese pet medicine market, including Boehringer Ingelheim and Merck Animal Health. One of the largest pet medicine companies in the world, Zoetis, recently began work on a new manufacturing facility in Suzhou.

The pet medicine industry is a relatively challenging and expensive one to operate in, and is therefore dominated by large pharmaceutical companies. One of the main challenges of operating in China for foreign companies is the requirement for medicines to undergo additional rounds of testing and certification in China before they can go on sale, a procedure that can take up to three years on top of the many years of R&D.

By looking at current socio-economic and demographic trends, we can be very confident in the prediction that China’s pet industry will continue to grow in the coming years and decades.

Although the total number of pets in China is large, the penetration rate of pets is still lower than in many other developed countries – just 20 percent to Japan’s 38 percent and the US’s 70 percent. As unmarried millennials progress into middle age and Gen Zers enter the workforce, the core existing and potential consumer base of the pet industry will become wealthier and more willing to spend on their pets, especially in the absence of children.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at [email protected].

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

Previous Article

« Guangzhou: Industry, Economics, and Policy

Next Article

Dezan Shira & Associates´ brochure offers a comprehensive overview of the services provided by the firm. With…

A firm understanding of China’s laws and regulations related to human resources and payroll management is ab…

Doing Business in China 2022 is designed to introduce the fundamentals of investing in China. Compiled by the …

With the scope and penalties of China’s social credit system being further clarified in 2021, legal and regu…

As a legitimate tool for reasonable tax planning and cost saving, tax incentives play an important role. Compa…

Over the last few months, China has been quickly expanding the pilot program on electronic special value-added…

Dezan Shira & Associates helps businesses establish, maintain, and grow their operations.

Stay Ahead of the curve in Emerging Asia. Our subscription service offers regular regulatory updates,

including the most recent legal, tax and accounting changes that affect your business.