- November 25, 2022

- No Comment

- 21 minutes read

Fresh Pet Food Market in US: Historic Industry Size & Analysis of 15 Vendors and 7 Countries – Yahoo Finance

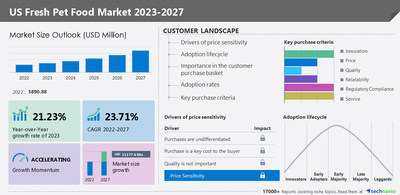

NEW YORK, Nov. 24, 2022 /PRNewswire/ — The fresh pet food market size in US is forecast to increase by USD 11177.6 million from 2022 to 2027, at a CAGR of 23.71%, according to the recent market study by Technavio. The growth of the market will be driven by the expansions of fresh pet food vendors, increasing focus on promoting fresh pet foods in US, and the rising demand for human-grade fresh pet foods.

Technavio categorizes the fresh pet food market in US as a part of the packaged foods and meats market, which covers manufacturers or food processing vendors that are involved in food processing to eliminate microorganisms and extend shelf life.

Charts & data tables about market and segment sizes for a historic period of five (2017-2021) years have been covered in this report. Download The Sample Report

Technavio has extensively analyzed 15 major vendors, including Arrow Reliance Inc., Artemis Pet Food Co., Carnivore Meat Co. LLC, Cooking4Canines, Fromm Family Foods LLC, Great American Dog Food Co., Havegard Farm Inc., JustFoodForDogs LLC, Mars Inc., My Perfect Pet Food Inc., NomNomNow Inc., Pauls Custom Pet Food LLC, Primal Pet Foods Inc., Rabbit Hole Hay Inc., and Raised Right Pets LP.

Key Benefits for Industry Players & Stakeholders –

The report offers information on the criticality of vendor inputs, including R&D, CAPEX, and technology.

It also provides detailed analyses of the market’s competitive landscape and vendors’ product offerings.

The report also provides a qualitative and quantitative analysis of vendors to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

Expand operations in the future – To get requisite details, ask for a custom report.

Customer Landscape – Analysis of Price Sensitivity, Adoption Lifecycle, Customer Purchase Basket, Adoption Rates, and Purchase Criteria by Technavio

One of the core components of the customer landscape is price sensitivity, an analysis of which will help companies refine marketing strategies to gain a competitive advantage.

Another key aspect is price sensitivity drivers (purchases are undifferentiated, purchase is a key cost to buyers, and quality is not important), which range between LOW and HIGH.

Furthermore, market adoption rates for all regions have been covered.

Download the sample to get a holistic overview of the fresh pet food market in US by industry experts to evaluate and develop growth strategies.

The market is segmented by distribution channel (offline and online), product (dog food, cat food, and others), and material (fish, meat, vegetable, and others).

Segmentation by distribution channel (Inclusion/Exclusion)

Inclusion:

The offline segment grew gradually by USD XXX million between 2017 and 2021. The offline distribution channel segment includes supermarkets and hypermarkets; pet specialty stores, pet clubs, and vet clinics; and convenience stores. These stores offer a wide collection of fresh pet foods from different brands and provide pet owners with a convenient option to select the required fresh pet food from various brands. They also provide opportunities for vendors to make in-store promotions of their fresh pet foods, which will help them attract more customers. Besides, the rising number of vet clinics and pet clubs are increasing the awareness of healthy pet food options such as fresh pet foods among consumers. All these factors are contributing to the growth of the offline distribution channel segment.

To get detailed insights about inclusions and exclusions, buy report!

Related Reports –

Frozen and Freeze Dried Pet Food Market by Distribution Channel and Geography – Forecast and Analysis 2022-2026 – size is estimated to increase by USD 2.06 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 10.41%, according to the recent market study by Technavio. Furthermore, this report extensively covers market segmentations by distribution channel (offline and online) and geography (North America, Europe, APAC, South America, and MEA).

Pet Food Market in Russia by Product and Type – Forecast and Analysis 2022-2026 – size is estimated to increase by USD 1.41 billion by 2026 with a progressing CAGR of 6.24%, according to the recent market study by Technavio. The rising awareness of pet nutrition is one of the key factors driving the market growth.

What are the key data covered in fresh pet food market in US?

CAGR of the market during the forecast period

Detailed information on factors that will drive the growth of the fresh pet food market in US between 2022 and 2027

Precise estimation of the size of the fresh pet food market in US and its contribution to the parent market

Accurate predictions about upcoming trends and changes in consumer behavior

Thorough analysis of the market’s competitive landscape and detailed information about vendors

Comprehensive analysis of factors that will challenge the growth of fresh pet food market vendors in US

Fresh Pet Food Market in US Scope

Report Coverage

Details

Page number

134

Base year

2022

Historical year

2017-2021

Forecast period

2023-2027

Growth momentum & CAGR

Accelerate at a CAGR of 23.71%

Market growth 2023-2027

USD 11177.6 million

Market structure

Fragmented

YoY growth (%)

21.23

Competitive landscape

Leading companies, Competitive Strategies, Consumer engagement scope

Key companies profiled

Arrow Reliance Inc., Artemis Pet Food Co., Carnivore Meat Co. LLC, Cooking4Canines, Fromm Family Foods LLC, Great American Dog Food Co., Havegard Farm Inc., JustFoodForDogs LLC, Mars Inc., My Perfect Pet Food Inc., NomNomNow Inc., Pauls Custom Pet Food LLC, Primal Pet Foods Inc., Rabbit Hole Hay Inc., and Raised Right Pets LP.

Market dynamics

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the forecast period.

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

Table of contents:

1 Executive Summary

1.1 Market overview

2 Market Landscape

2.1 Market ecosystem

3 Market Sizing

3.1 Market definition

3.2 Market segment analysis

3.3 Market size 2022

3.4 Market outlook: Forecast for 2022-2027

4 Five Forces Analysis

4.1 Five forces summary

4.2 Bargaining power of buyers

4.3 Bargaining power of suppliers

4.4 Threat of new entrants

4.5 Threat of substitutes

4.6 Threat of rivalry

4.7 Market condition

5 Market Segmentation by Distribution Channel

5.1 Market segments

5.2 Comparison by Distribution Channel

5.3 Offline – Market size and forecast 2022-2027

5.4 Online – Market size and forecast 2022-2027

5.5 Market opportunity by Distribution Channel

6 Market Segmentation by Product

6.1 Market segments

6.2 Comparison by Product

6.3 Dog food – Market size and forecast 2022-2027

6.4 Cat food – Market size and forecast 2022-2027

6.5 Others – Market size and forecast 2022-2027

6.6 Market opportunity by Product

7 Market Segmentation by Material

7.1 Market segments

7.2 Comparison by Material

7.3 Fish – Market size and forecast 2022-2027

7.4 Meat – Market size and forecast 2022-2027

7.5 Vegetable – Market size and forecast 2022-2027

7.6 Others – Market size and forecast 2022-2027

7.7 Market opportunity by Material

8 Customer Landscape

8.1 Customer landscape overview

9 Drivers, Challenges, and Trends

9.1 Market drivers

9.2 Market challenges

9.3 Impact of drivers and challenges

9.4 Market trends

10 Vendor Landscape

10.1 Overview

10.2 Vendor landscape

10.3 Landscape disruption

10.4 Industry risks

11 Vendor Analysis

11.1 Vendors covered

11.2 Market positioning of vendors

11.3 Arrow Reliance Inc.

11.4 Artemis Pet Food Co.

11.5 Carnivore Meat Co. LLC

11.6 Cooking4Canines

11.7 Freshpet Inc.

11.8 Great American Dog Food Co.

11.9 Havegard Farm Inc.

11.10 JustFoodForDogs LLC

11.11 My Perfect Pet Food Inc.

11.12 NomNomNow Inc.

11.13 Pauls Custom Pet Food LLC

11.14 Primal Pet Foods Inc.

11.15 Rabbit Hole Hay Inc.

11.16 The Farmers Dog Inc.

11.17 Whitebridge Pet Brands LLC

12 Appendix

12.1 Scope of the report

12.2 Inclusions and exclusions checklist

12.3 Currency conversion rates for US$

12.4 Research methodology

12.5 List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/fresh-pet-food-market-in-us-historic-industry-size–analysis-of-15-vendors-and-7-countries-301686253.html

SOURCE Technavio

Warren Buffett — the Oracle of Omaha — is widely regarded as one of the greatest investors of all time. Berkshire Hathaway Inc. (NYSE: BRK-A) has returned tens of thousands of percent over the years and consistently outperforms the market. Buffett purchased the company for just $8.3 million in 1965, and it’s now valued at nearly $700 billion, roughly a 10 million percent return. But one of Buffett’s top all-time picks and longest-held positions is one you might not expect. Berkshire Hathaway fir

Many seniors are all too familiar with the name Teva Pharmaceutical when they look at their medications as they refill their pill containers each week. Teva is known primarily as a manufacturer of generic drugs. Trading volume in TEVA looks like it has increased since May.

(Reuters) -Benchmark Brent oil edged lower on Thursday while West Texas Intermediate (WTI) crude held steady, hovering in sight of two-month lows as the level of a proposed G7 cap on the price of Russian oil raised doubts about how much it would limit supply. Brent crude futures were down 29 cents, or 0.3%, to $85.12 a barrel by 15.15 p.m. ET (2015 GMT), while U.S. WTI crude futures rose 2 cents, to $77.96. Both benchmarks plunged more than 3% on Wednesday on news the planned price cap on Russian oil could be above the current market level.

Amazon's (AMZN) AWS opens its second cloud region in Hyderabad, India, to solidify its APAC presence.

Chinese electric-car makers are increasingly taking market share from the German giant in its largest market.

Apple said it was working to resolve worker complaints at the world’s biggest iPhone factory in China, run by Foxconn, after police were filmed beating protesting employees this week.

Oil prices extended declines on Thursday as European Union leaders continued to discuss a price cap on Russian crude exports. Brent crude, the international standard, fell 0.7% to $85.83 a barrel, down from as high as $89 on Wednesday. West Texas Intermediate, the U.S. benchmark, slipped 0.6% to $77.50 a barrel.

At least when it comes to mining coal. After years of decline, demand for the polluting fossil fuel has surged this year as Europe scrambles to replace Russian gas, and coal miners are making money hand over fist. With coal prices hitting record highs, companies would normally expand their operations, but projects are being left on the table as most Western banks stand by climate pledges to restrict lending to the sector, according to a dozen mining company executives and investors.

The Zacks Medical – Instruments industry is growing on rising demand for digital health. SWAV, MLAB and DYNT are set to gain the most. Yet, the ongoing inflation in the form of rising freight, raw material and labor costs is an overhang.

Meta Platforms is nowhere among the world’s largest media companies.

Should you worry about the slowing rally in Dow Jones price-leader and health care stock UnitedHealth Group?

Software company Autodesk sank sharply Wednesday morning after revealing weaker-than-expected guidance, thanks to foreign exchange and macroeconomic challenges. Let's check out the charts to see if this weakness will precipitate further declines. In this daily bar chart of ADSK, below, we can see a price gap to the downside for ADSK.

Europe’s latest economic volley against Russia—a price cap on Russian oil—seems likely to land as a dud.

Things aren’t exactly improving for bitcoin miners. The companies that operate the computer equipment upon which the bitcoin network operates have been roiled over the past year by the crash in crypto markets. On Tuesday, Core Scientific reported it lost $435 million in the third quarter, compared with $16.6 million a year ago. For the first nine months of the year, it lost $1.7 billion, compared with $13.2 million a year ago. Third quarter revenue rose to $162.6 million from $113.1 million a ye

It hasn’t received a lot of attention that the outlook for Germany’s economy, Europe’s largest, is considerably better than it was just a few months ago. Russia’s invasion of Ukraine cut off a significant portion of the country’s national gas supplies. Energy prices spiked, and inflation shot up.

A surge in the cost of shipping oil between the world’s ports is buoying energy prices, even as a gloomy economic outlook has dragged down crude near its lowest levels of the year. Economic fallout from the war in Ukraine has severed many of the short oil- and petroleum-product trading routes across the Baltic and North seas. Now, as Europe scrambles to find new suppliers and Russia looks to send exports elsewhere, tankers are spending more time on water before reaching their destinations.

Officials failed to reach an agreement on Thursday in the latest attempt to hash out next steps in responding to Europe’s energy crisis.

Franco-Italian carmaker Stellantis said on Thursday it would reorganise its European dealers' network in July next year, starting from Austria, Belgium, Luxembourg and the Netherlands. "The rest of Europe will progressively follow in the implementation of the new distribution scheme", the group born from the merger of Fiat Chrysler and France's PSA said in a statement. As part of its efforts to cut costs and support investment for electrification, Stellantis last year said it would end all current sales and services contracts with European dealers for all of its 14 brands, from June 2023.

An emergency meeting of energy ministers Thursday only shows how the energy crisis tied to Russia's war in Ukraine has divided the 27-nation bloc in almost irreconcilable blocs.

In its weekly release, Baker Hughes Company (BKR) reports that the total U.S. rig count is up in five of the prior six weeks.